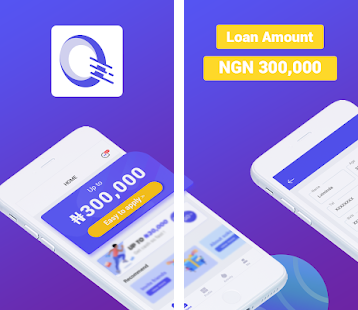

How to Get Quick Cash with 9ja Cash Loan App

9ja Cash Loan App Offers Instant Loans for Nigerians

Need cash quickly? As one of the top fintech apps in Nigeria, 9ja Cash Loan is revolutionizing consumer lending by providing fast, convenient access to funds directly through your smartphone.

Whether you’ve run into an unexpected expense or just need some extra cash on hand, 9ja Cash Loan’s streamlined application process could have the money you need deposited into your account within hours. Why wait days or deal with tedious paperwork when 9ja Cash Loan lets you tap into fast financing right from your mobile device?

If speed and convenience are your priorities, 9ja Cash Loan may be the solution you’re looking for.

About 9ja Cash Loans

Originally launched by the fintech company 9ja Cash, this specialized loan app provides Nigerians access to short-term personal loans ranging from 1,000 Naira up to 40,000 Naira. The convenience factor is huge since applications are 100% mobile through the 9ja Cash Loan app available on Android and iOS devices.

Once approved, loan proceeds get deposited directly into your connected bank account promptly. Repayment terms are flexible too, ranging from just 7 days out to 3 months maximum.

The 9ja Cash founders realized that traditional loans often come with lengthy applications leaving people waiting weeks for a decision. Their app delivers funds in under 2 hours instead so consumers can get pressing needs met rapidly.

How to Borrow Money From Branch Loan App?

Benefits of Using 9ja Cash Loan App

Here are some of the biggest perks borrowers can gain from using 9ja Cash versus banks or offline lenders:

- Very fast approvals & funding – Receive initial loan decision in minutes & money in under 2 hours when approved

- No collateral required – Loans get approved based on ability to repay; no asset pledging

- Easy application – 100% mobile process through phones – no physical documents

- Flexible repayment – Select payback terms from 7 days to 90 days

- For both salaried and self-employed – Wider eligibility than formal bank loans

- No hidden fees – Only nominal late fines; no application or processing fees

For quick emergency borrowing, 9ja Cash makes getting approved and funded painless.

Who Qualifies for a 9ja Cash Loan?

As an app-based platform with lower overheads than traditional lending, 9ja Cash uses technology and data analytics to extend loans to more Nigerians.

Eligibility basics include:

- Must be a Nigerian citizen over age 18

- Have a steady source of income whether salaried, self-employed or in business

- Provide basic ID like voters card, drivers license or passport

- Maintain an active bank account to receive the loan

Meeting these requirements allows your application for up to 40,000 Naira based on your affordability assessment.

How to Get GTBank Salary Advance Loans

What Are 9ja Cash Loan Interest Rates and Fees?

Instead of piles of paperwork, loans get assessed using algorithms processing thousands of data points. This translates into higher approvals plus personalized rates as low as:

- 5% over 7 days

- 10% over 30 days

- 20% over 90 days

Rates scale based on your specific loan length and eligibility factors. The maximum is 30%.

Unlike banks and offline lenders, 9ja Cash does not charge application or processing fees. But late repayments past your due date will incur fines from 100 Naira up to 1000 Naira depending on number of days overdue.

Steps to Getting a 9ja Cash Loan

Here is the smooth process 9ja Cash has established for borrowers:

- Download the 9ja Cash Loan app from PlayStore or iOS Store onto your mobile

- Register by creating your borrowing account securely with personal details

- Provide ID like voters card, license, or passport for verification

- Input income details and connect your bank account

- Get assessed in real-time using innovative data algorithms

- Receive loan decision instantly on your loan amount and terms

- Verify your mobile number via OTP SMS for final approval

- Get paid with loan proceeds to your bank under 2 hours!

The entire borrowing journey happens right on your phone in under 15 minutes total.

Tips to Borrow Responsibly with 9ja Cash Loans

Like any loan, borrowers should stay disciplined:

- Take only the amount you genuinely require and can repay

- Carefully check repayment schedules before accepting offers

- Avoid rolling over loans or paying late which incur big fines

- Manage your payments to build a healthy credit standing over time

Comparing rates across multiple lenders ensures you find the most competitive 9ja Cash loan offer. But being prudent and paying punctually is key to establishing good financial credibility through app lending channels.

Is 9ja Cash a Viable Instant Loan Option?

In the modern digital era, consumers expect speed and mobility in all experiences – banking included. As Nigeria’s first loan disbursement app, 9ja Cash Loan certainly delivers on that convenience.

For Nigerians who require access to quick funds due to unexpected contingencies or urgent needs, securing <2 hour loan approval online eliminates traditional barriers. Minimal viable documentation plus automated data-backed decisioning also expands access to formal credit channels. Even better, repayment flexibility in short durations makes loans manageable.

However, if you are borrowing, you must have to exercise restraint in loan amounts and disciplined payments. Fair lending regulations around transparency and digital rights should also be enacted long-term as app-based fintech balloons across Nigeria.

Conclusion

In closing, 9ja Cash Loan delivers an innovative fintech solution enabling Nigerians to access much-needed funds rapidly through their mobile phones.

Despite risks involved, prudent use can boost financial inclusion. But with prudent use, 9ja Cash Loan provides a revolutionary platform placing financial solutions directly in the hands of everyday Nigerians nationwide. The power of speedy, stress-free, and smartphone-based lending is here.