Sometimes life throws unexpected expenses and emergencies at us when we least expect it. Your car breaks down needing urgent repairs or a family member falls ill requiring hospitalization.

At such times, you need quick access to extra cash to tide over the crisis. But where do you find fast financing when you have no savings and payday is weeks away? Don’t worry, Carbon loans can help!

What are Carbon Loans?

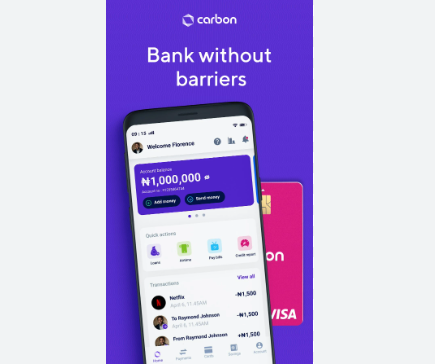

Carbon, now rebranded as Carbon, is an online lending platform that provides short-term instant loans. These small loans are designed to help individuals cover urgent financial needs or unexpected expenses. The entire application and disbursal process happens digitally making the service quick and convenient for borrowers.

Carbon offers loan amounts from ₦1,500 to ₦500,000 with flexible repayment tenors. The loans can be taken for any personal reasons and repaid comfortably over 3 to 90 days. Since the platform is entirely online, borrowers can apply for and receive funds within minutes right on their phones without paperwork.

Where do you find fast financing when you have no savings and payday is weeks away? Don’t worry, Carbon loans can help!

How Do Carbon Loans Work?

The loan application and disbursement mechanism of Carbon is seamless and completely digital:

- Get the Carbon app on your Android or iOS phone and register your details.

- Choose the loan amount you need depending on your requirement and repayment capability.

- Answer a few questions and submit your loan application on the app.

- You get a loan decision immediately based on automated risk algorithms.

- If approved, the loan amount is credited to your bank account within minutes.

The whole process from application to disbursal happens in less than 10 minutes! This makes Carbon ideal for instant access to funds.

Why Consider Carbon Loans?

Carbon loans offer several advantages that make them a convenient means to get short-term financing:

- Get loan decision in seconds and money in account instantly.

- 100% online application without paperwork or visits.

- Just basic KYC, income proof needed for approval.

- Borrow as low as ₦1,500 for your needs.

- Pick a tenure between 3-90 days.

- Unsecured loans, no need for guarantors or security.

- Apply anytime from your phone (24×7 access)

NPower Management Proposes a Payment of N60000 Per Month

When Do Carbon Loans Help?

Carbon loans can be useful in various situations that require urgent access to some extra cash:

- Pay hospital bills or buy medicines instantly.

- Fund a sudden tour, trip, or vacation.

- Pay urgent exam or test fees on time.

- Settle an urgent electricity, mobile or credit card bill.

- Pay for sudden repairs required.

- Get funds to manage until next payday.

- Expenses for family events like weddings.

So, whether it is an unexpected expense or an urgent requirement, Carbon loans can quickly provide the financing needed. The easy application process makes the funds available in minutes.

What is the Cost of Carbon Loans?

Carbon charges competitive interest rates starting at 6% per month. Some additional charges to consider are:

- Processing fee of 1.5% of loan amount

- Late payment penalty of ₦100 daily

- 10% collection fee on unpaid amounts

While the charges are reasonable, it is wise to repay on time to avoid extra penalties that can accumulate fast. Overall, the costs may be higher than traditional banks but lower than other online lenders. The convenience and speed of getting the funds often offsets the slightly higher pricing.

While the charges are reasonable, it is wise to repay on time to avoid extra penalties that can accumulate fast.

How to Repay Your Carbon Loan?

Repaying your Carbon loan is seamless as well. The amount is auto-debited from the bank account you registered at the time of applying for the loan. You can repay early with no pre-payment charges. Some tips for easy repayment:

- Set payment reminders so you don’t miss repayment date.

- Pay via direct bank transfer or Carbon’s partnered payment channels.

- Avoid late payment to not incur penalties that increase dues.

- Contact support if you foresee difficulty in repaying on time.

- Pay at least the minimum due amount and rollover balance.

As long as you repay on schedule, Carbon loans help meet your urgent cash requirements without hassles.

Who Can Apply for Carbon Loans?

The eligibility criteria to apply for Carbon loans are minimal:

- Age 18 years or older

- Verified Nigerian phone number and BVN

- Active bank account for loan disbursal and repayment

- Minimum 3 months account activity

- Annual income of at least ₦200,000

Can Sparkle Bank Function in Nigeria Without a BVN?

As long as you meet the basic KYC and income criteria, you can download the app and apply for a Carbon loan effortlessly.

Conclusion

Carbon (now Carbon) offers a convenient and quick way to secure short-term loans completely online. Its loan app and automated approval process makes accessing funds easy when you are facing urgent cash needs. Just check your eligibility, submit your application on the app, and get your loan disbursed within minutes.

With Carbon’s robust technology platform, getting short-term financing has never been quicker or hassle-free. So next time an unexpected expense arises, don’t fret – just use Carbon to get instant cash in your account!