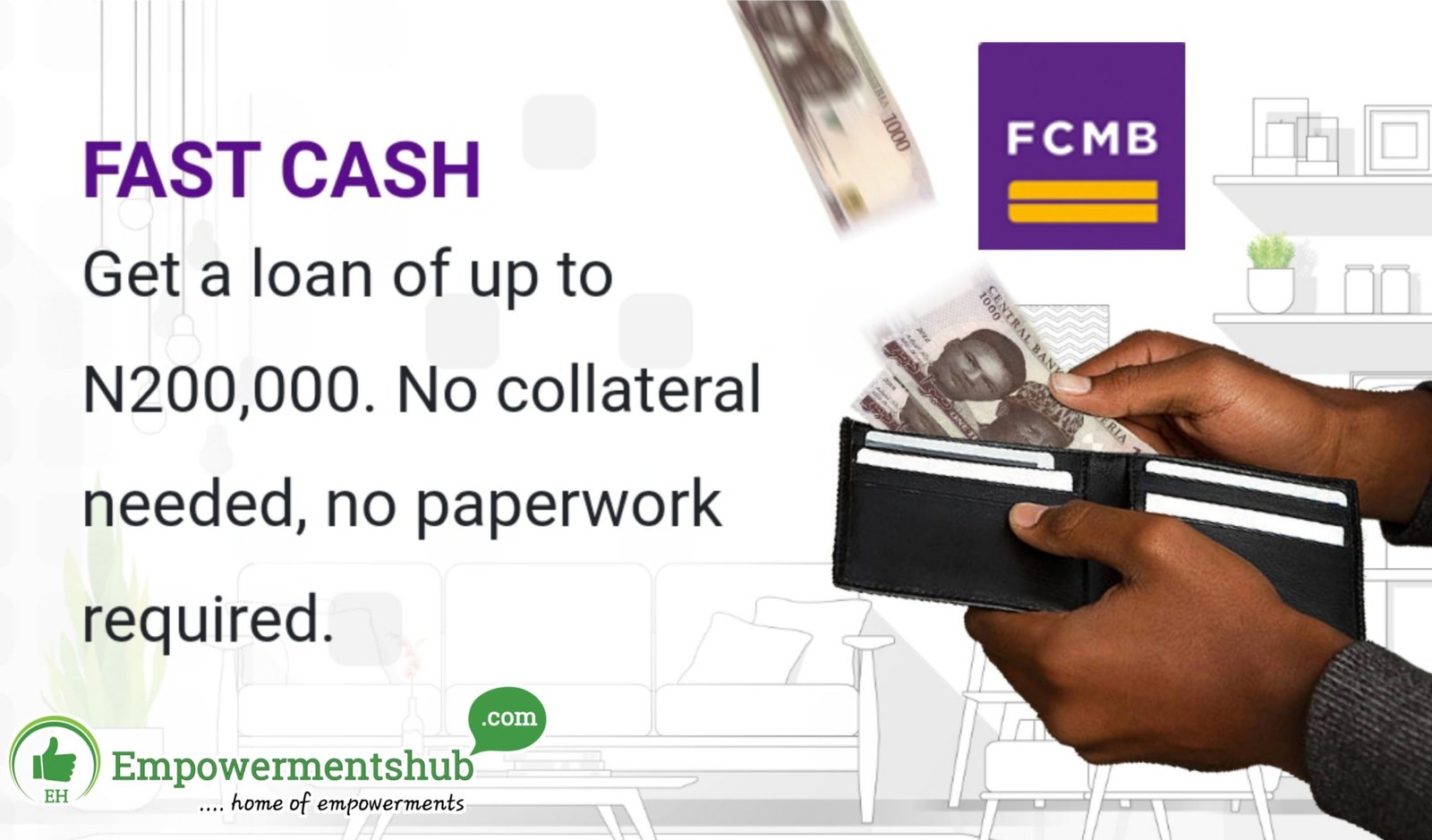

How To Apply for FCMB FastCash Loan UpTo N200,000

Every adult in Nigeria currently would admit to the difficulties and financial constraints that have been occasioned by these trying times. Hence, First City Monument Bank (FCMB) Nigeria, out of the abundance of its devotion to customer comfort, has launched an easy-to-use loan program for its Nigerian account users to mitigate the hardship and help them attend to urgent and important financial demands.

FCMB is devoted to providing every Nigerian with the assistance needed to surmount these times as the ever-trusting, compassionate, and responsive bank that it is.

FCMB has begun a new lending program known as “FastCash” with which Nigerians can now quickly access loan offers of up to N200,000 (two hundred thousand Naira) without the need for collateral. Sounds enticing, doesn’t it? Since the FastCash platform’s inception in 2018, more than 2.7 million loans have been distributed to Nigerians. So what are you waiting for?

In addition to that, Nigerians can now spread out their loan repayment over a maximum period of three months. This implies that clients using the FastCash program can now borrow more money while making smaller monthly payments.

FCMB FastCash is a practical, paperless credit facility that does not require any security. For many of its loans, the bank has digitized the application process, making it easier for customers to receive loans quickly and stress-free. If you have an FCMB account, you can apply instantly via the mobile app or USSD code 32911#.

Once you have successfully applied and found qualified for the loan, your account will be credited in less than five minutes. Yes! It is that fast.

However, presently, only FCMB clients are eligible for this deal. Hence, you need to create an account through the FCMB New Mobile Account Opening Portal to be able to access FastCash. If you do not have an account with First City Monument Bank, then dial *329# to open an account. It is a quick and easy process, just follow the procedures and provide accurate information requested.

Recommended: Nigeria Immigration Service List of Shortlisted Candidates 2023

FastCash is closely related to other lending solutions offered by the same bank, such as “Salary Plus.” Owners of pay accounts may apply for the Salary Plus Loan. Through this program, qualified FCMB customers can obtain short- or medium-term cash before receiving their paychecks to take care of pressing demands like paying their children’s school and emergency expenses.

Steps to Apply for an FCMB Fastcash Loan

FCMB Customers

You can apply instantly using the smartphone app (Mobile App), which you can download through your Play Store or just make use of the USSD code 32911#.

NON-FCMB Customers

It is of little advantage that the package is made only for FCMB customers; hence, non-FCMB customers are urged to open an account with FCMB bank before applying for the Fastcash loan by using the Mobile App or the USSD code 32911#.

Benefits of Fastcash Loan to Beneficiaries

Beneficiaries have access to quick financial rescue once the application is complete. They have straight access to a maximum loan amount of N200,000.

Application is easy, you can use the mobile app or dial 32911#. With no paperwork necessary, you can apply from the comfort of your home.

No security is necessary.

New customers receive 30-day tenors free.

For returning customers, a 90-day cleaning cycle is possible.

There is no limitation to the number of times a customer can apply in a calendar year; hence, a faithful customer may apply as many times as necessary.

Conclusion

With the number of credit facilities FCMB provides, it aims to reach out to customers with the financial help they require when it matters most. The bank hopes to have a substantial impact on the lives of their clients and Nigerians in general. It provides enticing lending solutions that you should key into for your urgent and emergency needs.

For more details, visit https://www.fcmb.com/fastcash-loan

FAQs

How do you qualify for FCMB FastCash?

Dial *329# to receive a loan of up to N100,000 from FCMB FastCash in just a few short minutes! No paperwork, collateral, or delays are present. To begin, simply dial *329# at this time.

How can I get a loan using USSD code?

To get a loan with a USSD code, you have to take the following steps:

Choose the loan provider you want to borrow from.

Get the operational USSD code of the loan provider.

Meet up with all specified requirements.

Dial the USSD code applicable to the loan provider.

Follow the prompt and specify the loan amount.

Get your loan.