Okash Loan Account – How To Close, Delete, Or Deactivate Okash Loan Account

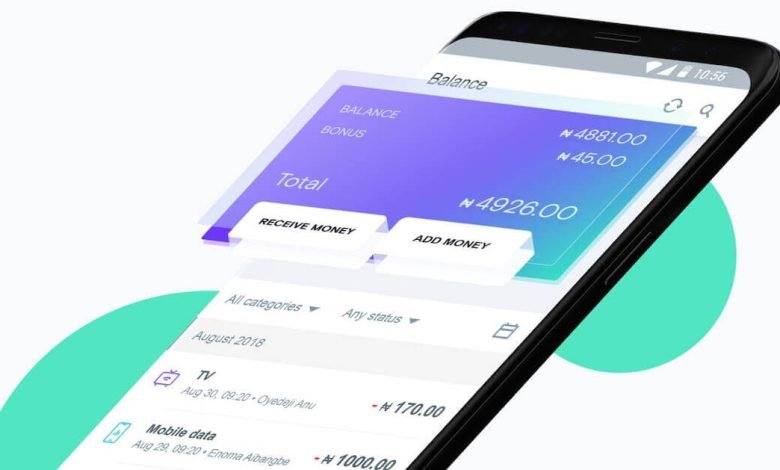

You may have be aware of the Okash loan app, a well-liked mobile application that offers fast microloans to people in need of money. It is primarily made to provide quick and easy access to modest loans, mostly for private or urgent needs.

Through the elimination of time-consuming documentation and conventional loan application procedures, the app seeks to streamline the borrowing process.

I’ll explain to you how to quickly terminate, erase, or deactivate your Okash loan account in this article.

Deactivation Process For Okash Loan Account

The easiest method to keep yourself from giving into the temptation to borrow money on the Okash loan app may be to completely delete your Okash account.

You can do this by deactivating, deleting, or canceling your Okash loan account.

To easily terminate, delete, or deactivate your Okash loan account, the best and quickest method is to adhere to the directions provided in this article.

The actions you must take to ensure that your Okash loan account is shut down are listed below:

Open the email program on your smartphone.

Contact the Okash Loan customer service representative by email. Usually, the official website or the Okash app itself provide the customer service email address details.

Indicate your wish to shut, delete, or deactivate your Okash account in the subject line of the email.

Give your account information, such as your registered email address or mobile number linked to your Okash account, in the email’s body. They will undoubtedly rapidly locate your account with this.

Inform them of any potential justifications for your want to shut, delete, or deactivate your account. Although it’s not required, giving a justification can help the business improve its offerings.

In the email, ask for confirmation that the account has been closed, deleted, or deactivated. This makes sure that you have a record of your request and any correspondence surrounding it in the future.

Verify the email’s accuracy and thoroughness to make sure it has all relevant information.

To send the email to Okash’s customer service department, click “Send”.

Your Okash loan account should be terminated within 24 hours of this email being delivered successfully.

Frequently Asked Questions

Here are some asked questions, about closing, deleting or deactivating your Okash Loan Account along with their answers;

How Does Okash Determine If Someone Is Eligible For A Loan?

Okash considers factors like credit history, income level, repayment behavior and other relevant data while assessing loan eligibility.

They use data analytics and algorithms to evaluate your creditworthiness and decide if you qualify for a loan.

What Are The Available Loan Amounts From Okash?

Okash offers small loan amounts that typically range from a hundred to thousand units of local currency. Okash checks your Creditworthiness and other factors to determine the amount of money you can borrow.

What Is The Repayment Time Period On Okash Loans?

Okash loans repayment is usually range from a few days to a month. The repayment and terms depends on your loan offer and the agreement you have with Okash.

How Can I Repay My Loan On Okash?

Okash had made repayments of loan very convenient for borrowers. They have provided different methods for repaying loans. They also help by sending Notifications and Reminders regarding the due date repayment.

Is There Any Interest Rate Or Fees On Okash Loan?

Yes, Okash charge fees and interest on their loans. Due to their speed and convenience on Okash, Their fees are slightly higher compare to other commercial banks. Keep this in mind before accepting any loan offers.

It is also important to review the loan terms, interest rates and fees.

Can The Repayment Period For My Okash Loan Be Extended?

In cases Okash may offer options for loan extensions or renewals. However, whether these options are available, their associated terms will depend on Okash policies and your specific loan agreement.

To get assistance regarding loan extensions or renewals it would be best to contact Okash customer support.

GoCash Loan – How to Get A Loan from GoCash

What Happens If I Am Unable To Repay My Okash Loan On Time?

If you fail to repay your Okash loan within the agreed upon timeframe, there may be fees, penalties or negative effects on your credit history.

It is crucial to consider your repayment capabilities and ensure that you can comfortably repay the loan within the given timeframe. If you anticipate difficulties in repayment, it is advisable to contact Okash customer support as soon as possible in order to discuss potential solutions.

Conclusion

To summarize, the Okash loan app provides an accessible platform for individuals who require financial assistance. With its user interface, application process and fast approval of loans Okash aims to offer instant microloans for personal or emergency purposes.

Nevertheless it is important to use Okash wisely and take into account the interest rates, fees and repayment terms that come with the loans.

If you wish to close, delete or deactivate your Okash account, the efficient and recommended way is to contact them through email. Likewise if you desire to reactivate your Okash account it is advisable to reach out to their customer support, for assistance.